The FOMC meeting this week will go down as one of the most memorable in recent history. Yes the Fed raised the benchmark rate 25 basis points into a range between 1.00% and 1.25%, which was widely accepted. Where the Fed surprised markets is announcing a plan to wind down the balance sheet (and 8 years of stimulus with it). The Fed plans to reduce their $4.5 trillion balance sheet through two mechanisms. They will start by reducing the balance sheet by $6 billion a month in Treasuries and $4 billion a month in mortgage-backed securities. This amount will increase over time until they reduce the balance sheet at a pace of $50 billion per month (or $600 billion a year). Once the balance sheet is reduced to approximately $2 trillion then the wind down should stop.

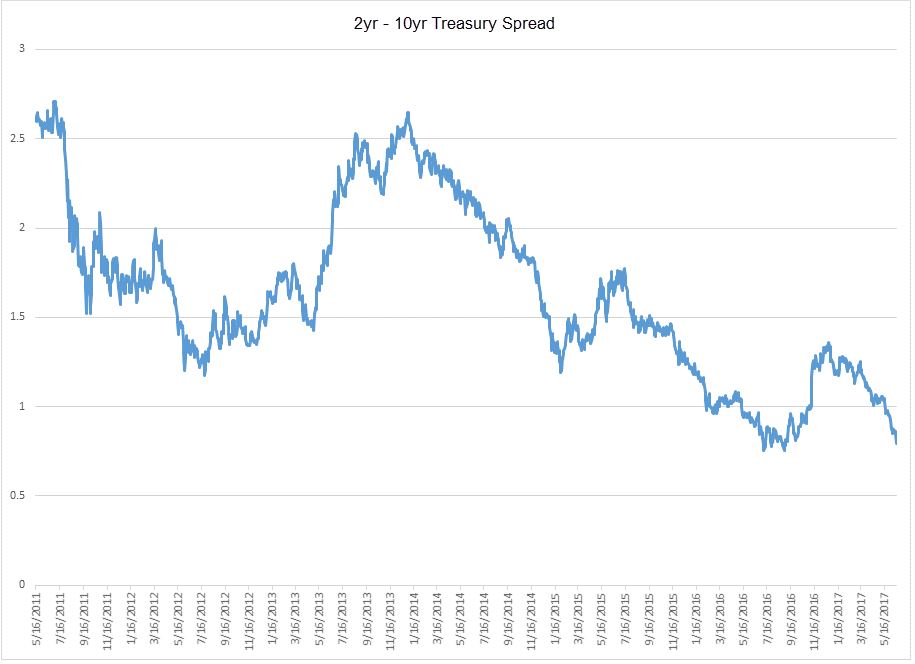

The Fed also updated its forecasts for interest rates and inflation. The projection for inflation for 2017 was reduced to 1.6% from 1.9% and the Fed still anticipates one more rate increase this year but three next year. If the Fed follows through with those increases then the FOMC’s benchmark overnight rate would be 2.13%. Currently the 10yr Treasury is trading at 2.13%. Let that sink it. The overnight borrowing rate will be 2.13% in a year and half but an investment earning 2.13% annually would require an investor to tie up their funds in Treasuries for 10 years! Why buy a 10yr Treasury?

Or to put it another way, the FOMC raised rates 25bps this week and long term rates dropped. The yield curve continues to flatten (see graph below) while the Fed is forcing their narrative on the market. They want to remove accommodation, build support for future rate changes in case of economic retraction and simultaneously not spook markets or liquidity. One would expect with this announcement that the markets would price longer term Treasuries at a higher yield and mortgage rates would follow. Recall that Ben Bernanke during 2013 mentioned the possibility of unwinding some stimulus and that sent rates up 100bps. With this meeting the market had already priced in the rate increase but did not expect the balance sheet announcement. Rates didn’t move higher because the long term Treasury market is not very concerned about inflation of any form and likely believes the Fed will have to lower rates sometime in the future.

This is a very dangerous game being played and the flattening of the yield curve should be taken seriously. How the Fed unwinds the balance sheet (with or without rate increases) could profoundly affect rates. I’m sure they will clarify if the unwinding is in lieu of the increase or in addition to. Either way be cautious of rate volatility. If the Fed is right, longer term rates are moving much higher. If the market is right, the Fed will have to lower short term rates.

Side note: this isn’t the only threat to interest rates. Tax reform, GSE reform and regulatory reform are all under review and reconsideration. Any changes there could drastically affect interest rates and the housing market. Please get involved and let your voices be heard. We are at a pivotal point and our legislators are listening. The new administration needs feedback and support before anything is written into law. See link below on joining the Mortgage Action Alliance to support our industry and homeowners. http://apps.mba.org/Advocacy/MortgageActionAlliance/MAASignup.htm

Watch the video here!