Meet Molly.

A story of bravery, honesty and her home and bun oven buying experience.

Molly grew up in an amazing family. Her parents have been married for over 35 years and are still best friends. She has a brother a year and a half older, someone that she always has looked up to. Sounds lovely and perfect. Even more special, is the fact that she has an identical twin sister with whom she shares a bond with that is so special most people could never understand.

Molly and her twin sister were always by each other’s side, but as twins they were always compared to one another. Jumping right in…they were so close and struggled so much with body issues they battled a severe three years of anorexia together.

They slipped deeper and deeper into eating disorders and lost more and more weight, while alienating those closest to them. They lost their friends and began to even shut out those most important to them—their family.

After years of battling and the constant comparison of measuring food and exercise they were exhausted. But one great fear they had, next to death, was not having kids and a family of their own. They feared they’d never become mothers.

What does this have to do with buying a house? Good question.

At 36 years old, Molly also feared that she’d never be able to own a home in California much less in the Pacific Palisades.

She was raised that you need to invest and you need to BUY something.

And the first question she needed answered was “well what can I afford?”

In comes big brother Beny, that’s right that big brother from earlier. He pretty much had to lay it out for her that she wasn’t going to be able to afford quite what she had envisioned right out of the gates. Another fear confirmed.

As she went looking for places that were “in her budget” she couldn’t believe what she COULDN’T get for her dollar.

“Everything was a dump!” Molly exclaimed.

Well NO KIDDING!

It is something that this particular age bracket struggles with, especially as a single earner, here in California where she has worked as a stylist for over 9 years at Elyse Walker in Pacific Palisades.

What we get for our dollar now is tough for the majority of us to swallow. “I get WHAT for $750,000?”

Um…palm to forehead. I need a drink.

Not unlike her doubts about her body and her ability to become a mother, she doubted and asked herself “can I do this?” Can I afford to buy a house all by my tiny self?”

It seemed like she looked at a million places every weekend and even put in offers on some and every time she was outbid by people paying all cash. Discouragement set in because there was no way she could possibly compete! Damnit, she needed a loan!

She couldn’t believe the speed at which the houses were flying off the shelves and that they were going far above the asking price. Was it ever going to be in her cards to be a home owner or what?

One day she looked at one place, a little over her budget (actually more than a little) and she fell in love. It needed no work! But after coming home and crunching numbers with what she brought in and what the down payment would need to be she decided not to even put in an offer. It was too much.

Tick tock…time keeps going by. But one morning the one she loved popped back up again and she figured must have fallen out of escrow. Her family and Molly discussed it with Beny and with a little help from them she was able to give more of a down payment to make her mortgage closer to something she could afford. And the best part was that she wouldn’t need to completely gut the place!

Her offer was accepted! Finally!!!! And so, the mortgage process began.

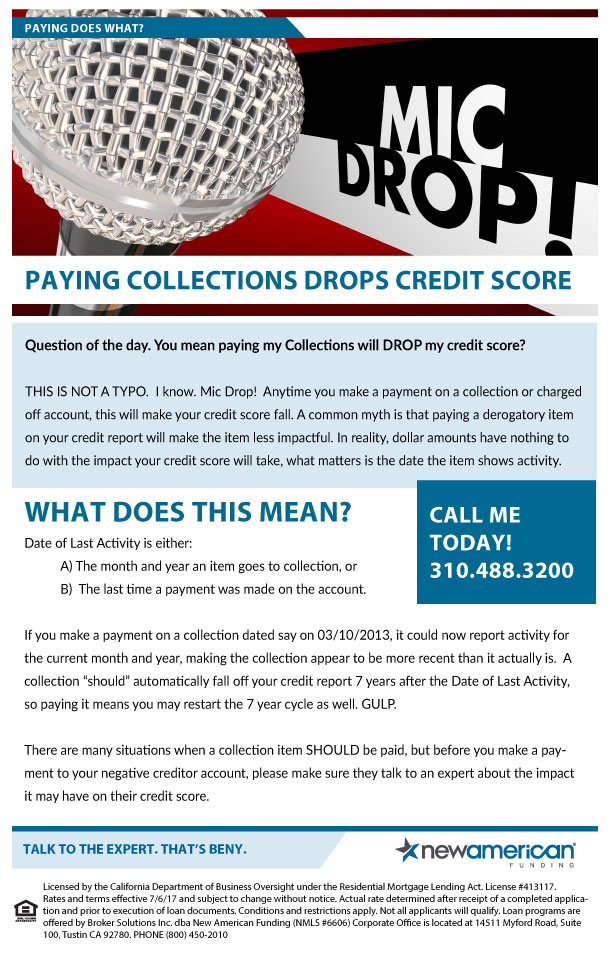

The process was relatively easy, but overwhelming at times. So many things are involved. Wire transfers, paperwork, proof of employment, inspections, blah blah. It felt never ending! Beny was super involved throughout the entire process and even caught something with her credit that she never even knew about!

The mortgage process can be confusing so he really helped her to understand the process and also guided her on things that were super time sensitive. He helped Molly to be calm through what seemed like a whirlwind of work to actually get the house. There is so much back and forth throughout the mortgage process and Beny helped to close on the house quickly because he was so on top of each step that needed to be done and even called on some things for on behalf of Molly to ensure it was getting done.

I don’t think everyone is like this.

I truly believe Molly would not have this beautiful home if it weren’t for him. Yes, he is Molly’s brother, but I also know how hard working he is and how much he cares for his clients. He is always working! And I know many people appreciate this about him.

Oh yeah and back to the baby issue…

In the midst of the home buying process, she still struggled with the fact that she wasn’t a mother. Didn’t have her own family yet and wanted to take some action towards it. Molly was just “over” finding the right mate to have a family with, she decided to go into fertility treatment to have her own family the way she wanted it to be. The Molly way.

As a single woman, she decided to go for it and go thru fertility treatment alone. She went thru the many challenges and emotions that face any woman who goes through this process of conception outside of the “normal way”. What is normal anyways? Blah.

After multiple rounds of treatments, Molly got pregnant. From her first ultrasound she found out that she was carrying multiples. Another fear…more than one baby!? How would she manage that as a single mom?

She made a decision with her fertility doctor that reducing from twins to a singleton was going to be the best option for her. And don’t judge. Not only were both babies at risk, but her health could also be at risk.

As she waited for the procedure, her mind going back and forth about whether she was doing the right thing, the doctor said, “there is something wrong with baby A’s heart.” The heart was far to the side rather than more towards the center and the stomach was up in the diaphragm causing the heart to be where it was.

“How could yet another thing be happening to me? This kind of stuff only happens to other people,” said Molly.

The reduction decision was a hard one for her, but now at 6 months pregnant her mind is at ease because she knows she has one healthy baby. With her being a twin, I can understand how much harder this decision must have been for her considering the insanely close bond they share and how in the back of her mind she just might feel like her baby BOY might be missing that bond. But that bond could not have been at the expense of all 3 lives.

Needless to say, she faced that challenge head-on and faced the home buying challenge simultaneously.

Her story is one that brings tears to your eyes and also one that inspires—making us take a step back to realize that everyone has their “stuff” and goes thru challenges we need to face head on.

We all can make our dreams come true no matter what they are. She got both–the baby and the beautiful home to raise her baby boy, right by the beach in sunny Southern California.

Beny helped her thru both of these challenges. He had her back then, and he has her back now. Find out more about how Beny can help you make your dreams come true as you walk down the home buying path.

To learn more about Molly’s personal journey, follow her blog “Molly’s Choice” at:

https://mollyschoice.com/

Or go visit her at the salon Elyse Walker in Pacific Palisades:

http://elysewalker.com/stylists

Through Adversity We Rise May 15th, 2018lshadmin