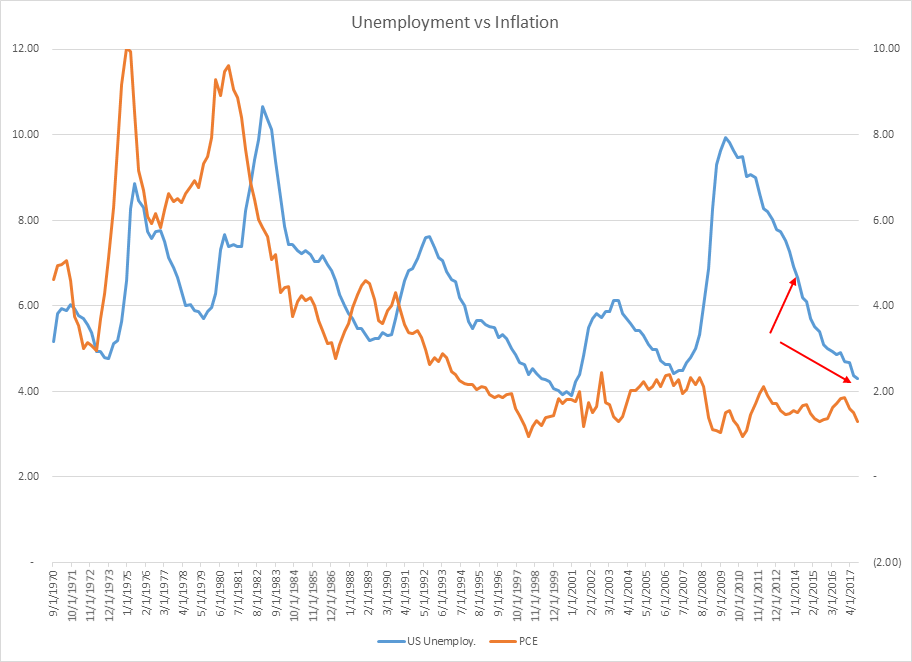

I think the Phillips Curve has been broken. Long known for its historic and inverse relationship between unemployment rates and rates of inflation, it doesn’t apply today. Or at least for the past few years there doesn’t seem to be a correlation. Effectively the premise behind the curve is that as the unemployment rate moves down, inflation will move up (and vice versa). We’ve certainly seen the unemployment rate move down and over the past two years, inflation started to move higher before dropping even further. The graph below points out this observation with the red arrows. Inflation is not following the Phillips Curve.

And the Federal Reserve, in all of its stubbornness believes at some point the correlation will hold; it’s a temporary setback; the drop in inflation is transitory if you will. In the past 30 days they announced the unwinding of the balance sheet to begin this month as well as they plan to raise rates in December (market odds currently at 77% vs 23% a month ago). With PCE currently at 1.3% year-over-year versus their 2.0% target, how do you justify more rate increases and the unwinding of the balance sheet simultaneously?

The answer is and will always be the Phillips curve. It certainly cannot be related to the high probability of tax reform or infrastructure spending or any type of stimulus package coming out of Washington. That dream likely died not long into 2017. But a hawkish Fed is always to be respected and the current 2.35% on the 10 yr (which is up 30bps in the last month) is a result of the plans to unwind the balance sheet and raise rates again in December.

The good news, however, is that the Fed controls the front end of the curve, the overnight rate. Mortgage rates trade closely with the longer end of the curve such as the 10 yr Treasury and low inflation and subdued growth should keep rates low for the foreseeable future.

Economic Calendar

- Oct 12th PPI

- Oct 13th CPI

- Oct 19th Jobless Claims / Leading Index

Want to watch the full market update? We thought you would.

Check it out!