Today we are going to talk about what’s happening in the capital markets.

The FOMC meeting came and went last week with little change in the Fed’s stance of 3-4 interest rate increases for 2018. If anything the Fed was slightly more dovish in their tone when they stated it’s possible they could slightly overshoot their inflation target of 2%. The translation of that means that perhaps there will only be three interest rate increases this year.

Thanks to those comments by the Fed, the 10yr has held under 3.03% and currently sits at 2.99%.

Speaking of inflation, all indications suggest inflation is starting to rise rapidly and the chart on your screen shows the Fed’s preferred inflation measurement PCE. You will notice that it’s quickly rising towards 2%, which is what has caused rates to continue to rise over the past several months.

With inflation rising this rapidly the market was assuming the Fed would have to raise rates four times this year to slow it down. As I mentioned earlier with the Fed’s comments about slightly overshooting 2%, I wouldn’t expect the Fed to raise rates four times this year unless inflation rose closer to 2.5%.

The general consensus is that the Fed will raise rates in June and September with no increase in the 4th quarter.

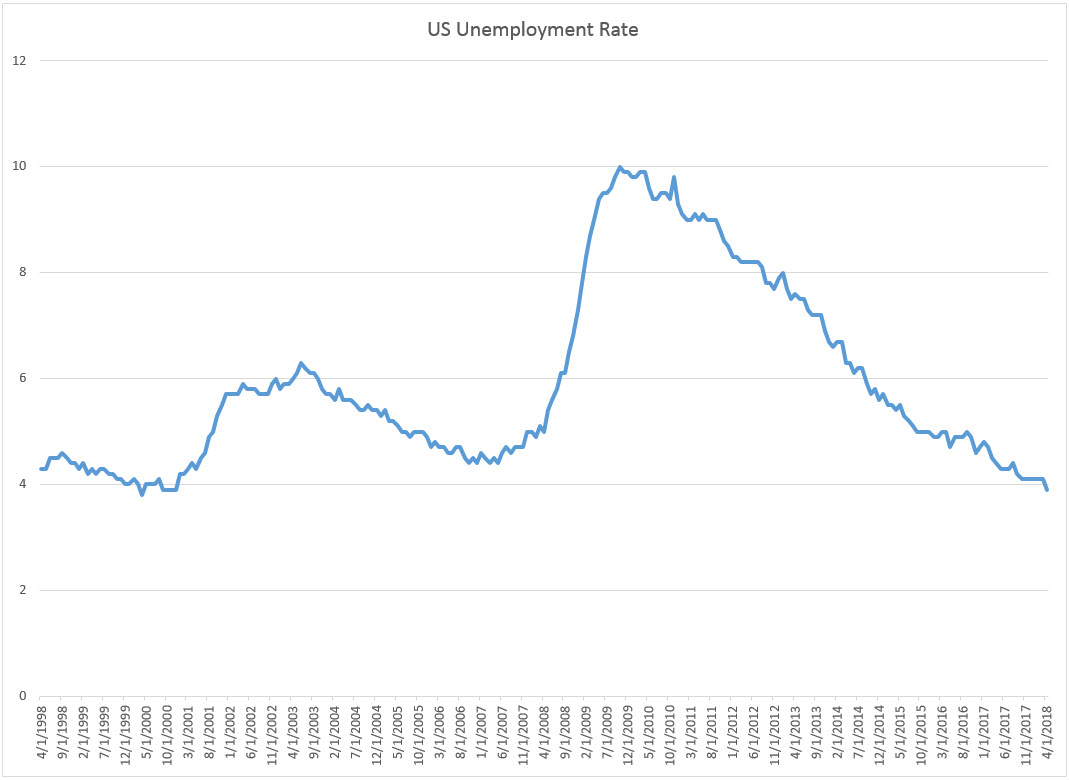

On the economic data front, the payroll report came out last week with the Unemployment rate at 3.9%, well below the Fed’s target. The graph on your screen shows the UE rate over the past 20 years and as you can see it’s near the low of 3.8% reached back in 2000.

With rising inflation and a low unemployment rate, how long can the 10yr remain below 3.03%.

Read more HERE

In the coming weeks you should keep an eye on the following items:

1. Inflation data will continue to take the spotlight, will it continue to rise at this fast pace?

2. Most economic news won’t be available for a few more weeks so continue to watch stock prices. If they continue to rise it will put pressure on the 10yr in breaking above 3%.

Have a hankering to watch the full lowdown about the rundown? Of course you do!