Unwinding unprecedented stimulus is no easy task. We don’t envy the Fed’s position of raising interest rates to a more sustainable level as well as reducing the balance sheet, the $4.5 trillion balance sheet. And don’t forget to not scare the stock and bond markets, protect the labor market and maintain pricing stability with good GDP growth. Not to mention leaving out politics, fiscal policy, health care reform, tax reform and other items beyond the Fed’s control.

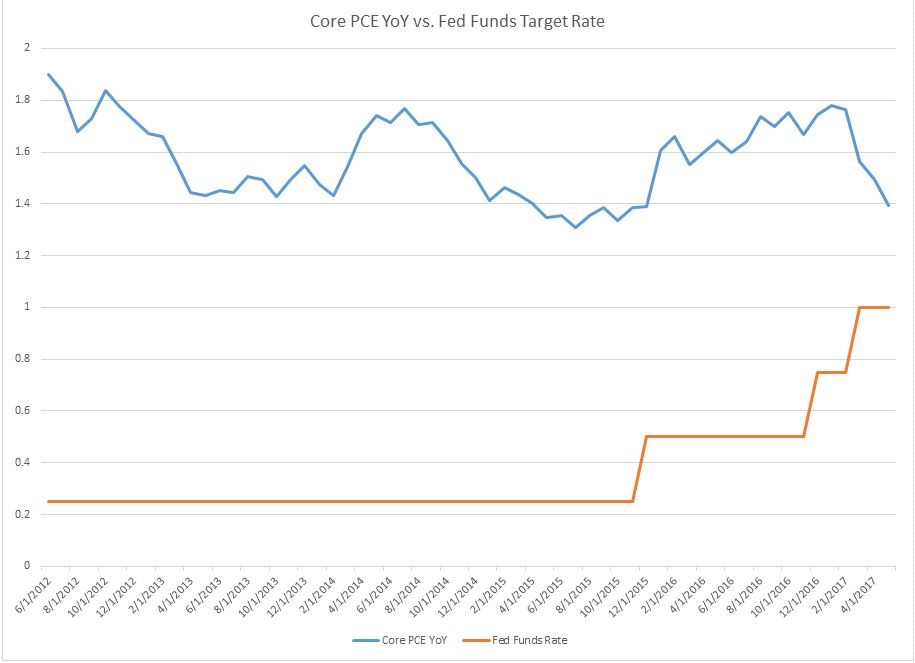

So when Core PCE was trending at close to 1.8% year over year in January, a new administration with huge growth plans was in office and all seemed right with the world; the prospect of three or maybe four rate raises this year seemed very palatable. Six months into the year, the labor market is strong, however Core PCE year over year is now down to 1.4% and potentially still falling, the Fed has raised interest rates twice with the possibility of a third AND they are considering reducing the balance sheet simultaneously; not to mention failure on both tax and health care overhaul so far. Doesn’t it seem a little premature to celebrate?

See chart below which plots the Fed Funds target rate versus Core PCE year over year. As you can see most recently the Fed Funds rate continues to move higher at the same time that Core PCE is coming down. Is the Fed acting too soon or are they acting appropriately given that Fed policy decisions today affect inflation figures months down the road?

Cut plain and simple, if the blue line continues to drop then the Fed was wrong. They will need to stop raising rates, potentially lower rates depending upon how low inflation goes and get a big ‘I told you so’ from the market. If Core PCE moves up and stays above the 1.5% annual rate then the Fed likely acted appropriately. But it’s still not that simple: raising rates is one thing and reducing the balance sheet is another. One has been done with moderate success many times while the other has never been done. Ben Bernanke was skewered for mentioning the tapering of asset purchases in 2013 and saw rates rise 100bps in 90 days for even suggesting it. The actual act of reducing the balance sheet will have unknown consequences.

There is a 99% chance the Fed will be second-guessed no matter which way they decide to go: raise rates, reduce the balance sheet or both. For the Fed to back off either stance would be a major display of weakness. More likely than not the Fed will move forward as it might be too late to change their mind. Of course I say that with some sarcasm. How many times has the Fed predicted rate increases for the year and not followed through with them?

Keep a close eye on inflation because this could be a wild ride.